美元加息

俄烏衝突

中美關係緊張

通貨膨脹…..

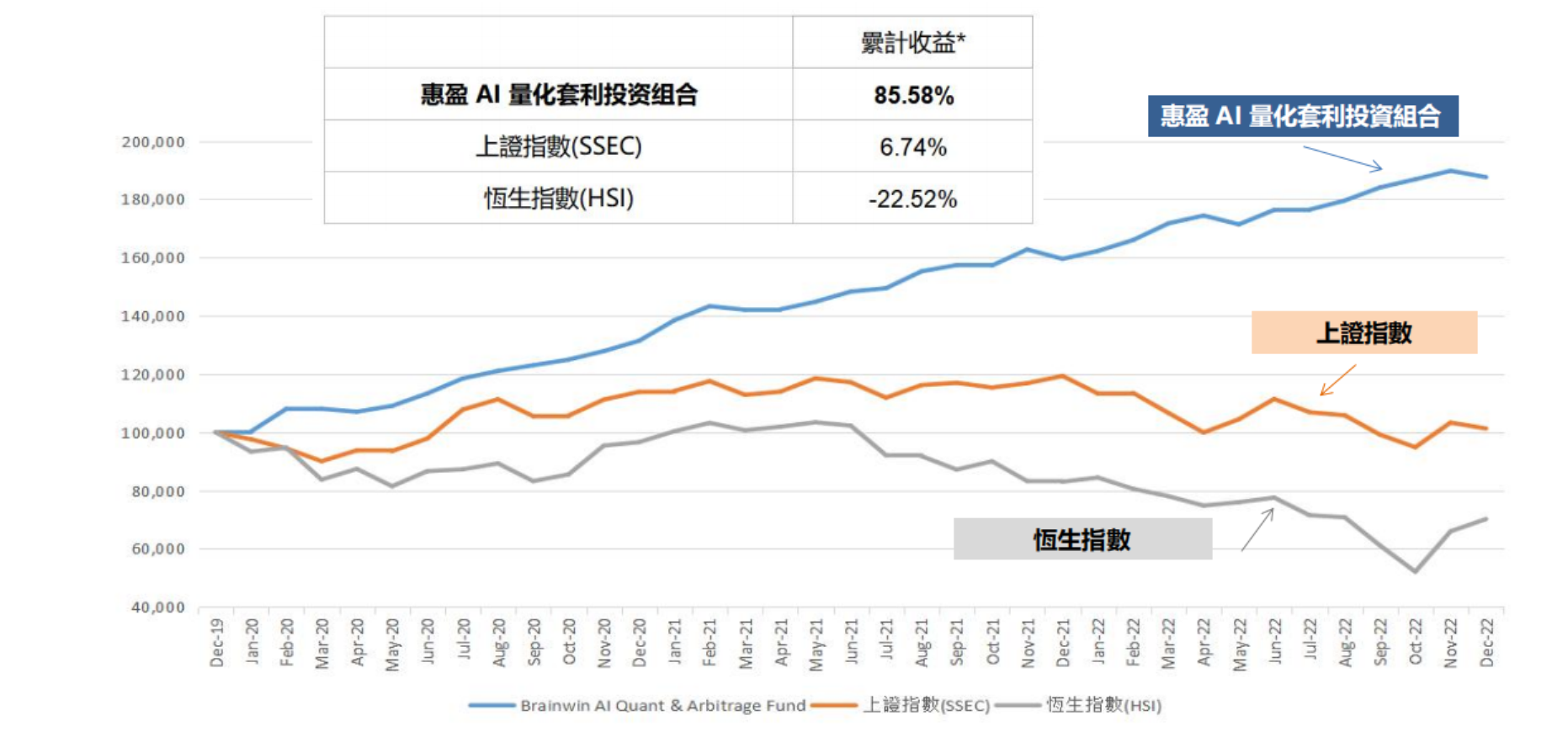

外匯(JPY/USD,EUR/USD,GBP/USD等),科技股(特别是中概股,如阿裏巴巴、騰訊控股等)、都從高位顯著下跌,跌幅高達20%-80%。

• 低市場相關性

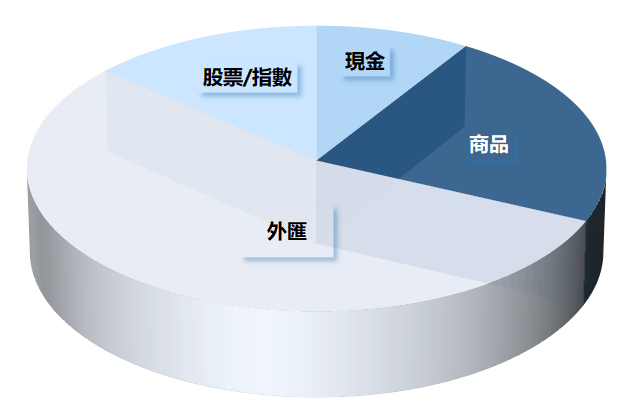

• 捕捉多資產類別的市場趨勢

• 低波動率

• AI系統:嚴控風險,提升回報

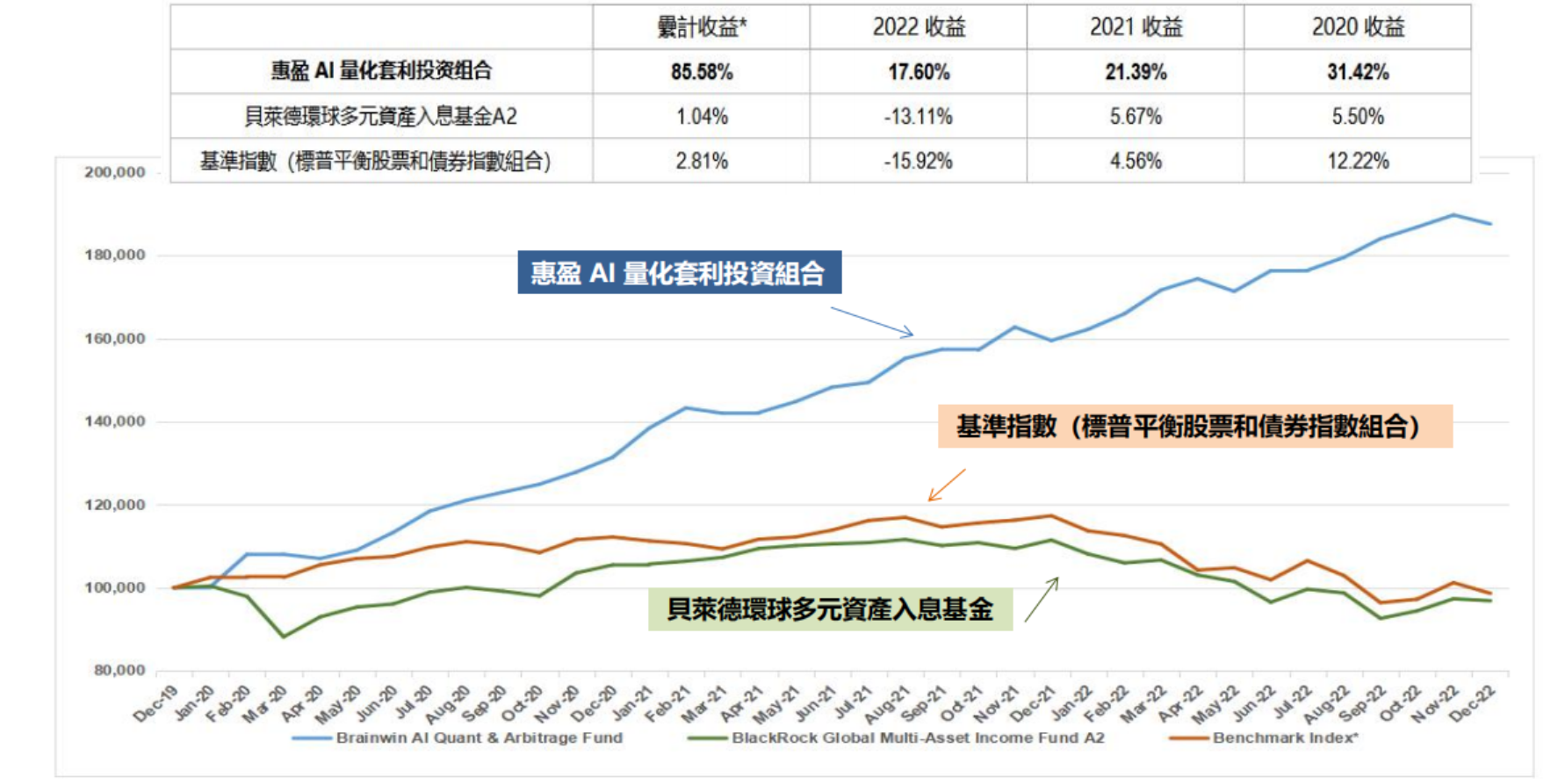

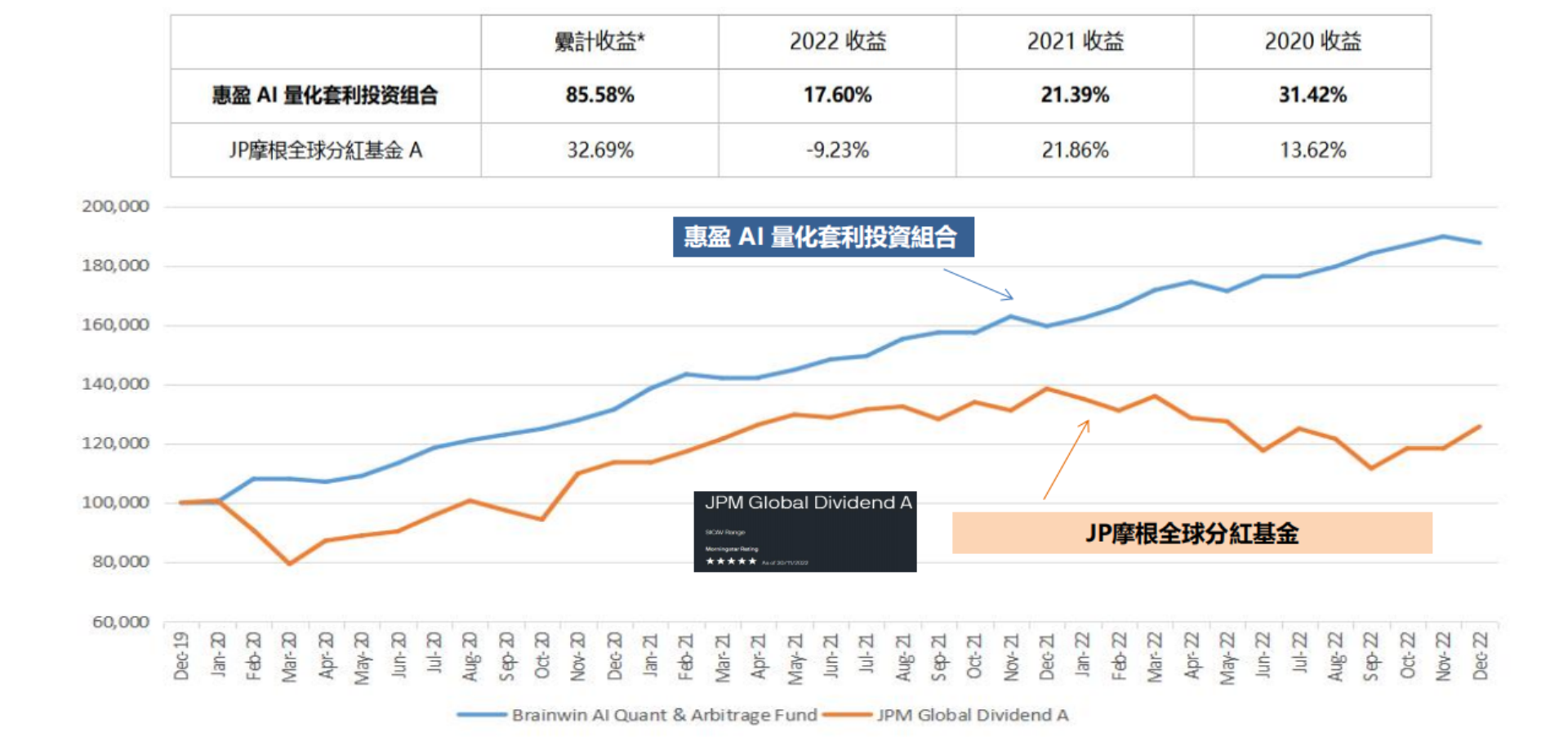

**實際表現由多類別資產量化套利團隊以相同策略運行的投資組合計算,相關內容和資料真實。該數據是由不同的交易所產生的,已減去管理費和表現費,基金產生的專業費用及其他相關費用未計入,因此不能保證其實際正確性。

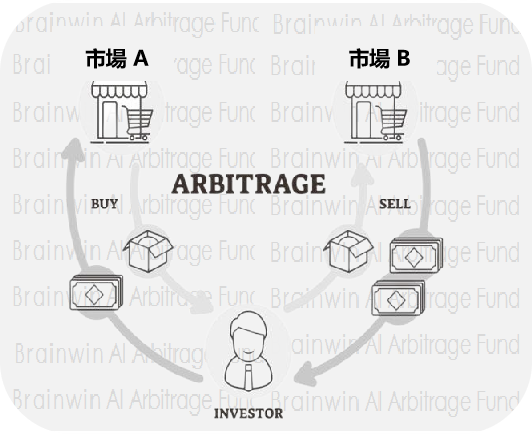

| 投資目標 | 本基金的主要投資目標是運用我們多元化的量化和套利交易策略,實現低波動和高絕對回報。基金透過AI人工智慧交易系統來操作,而此系統24小時自動化地捕捉在全球交易所的股票、商品、外匯、期貨及衍生品的投資機會。 |

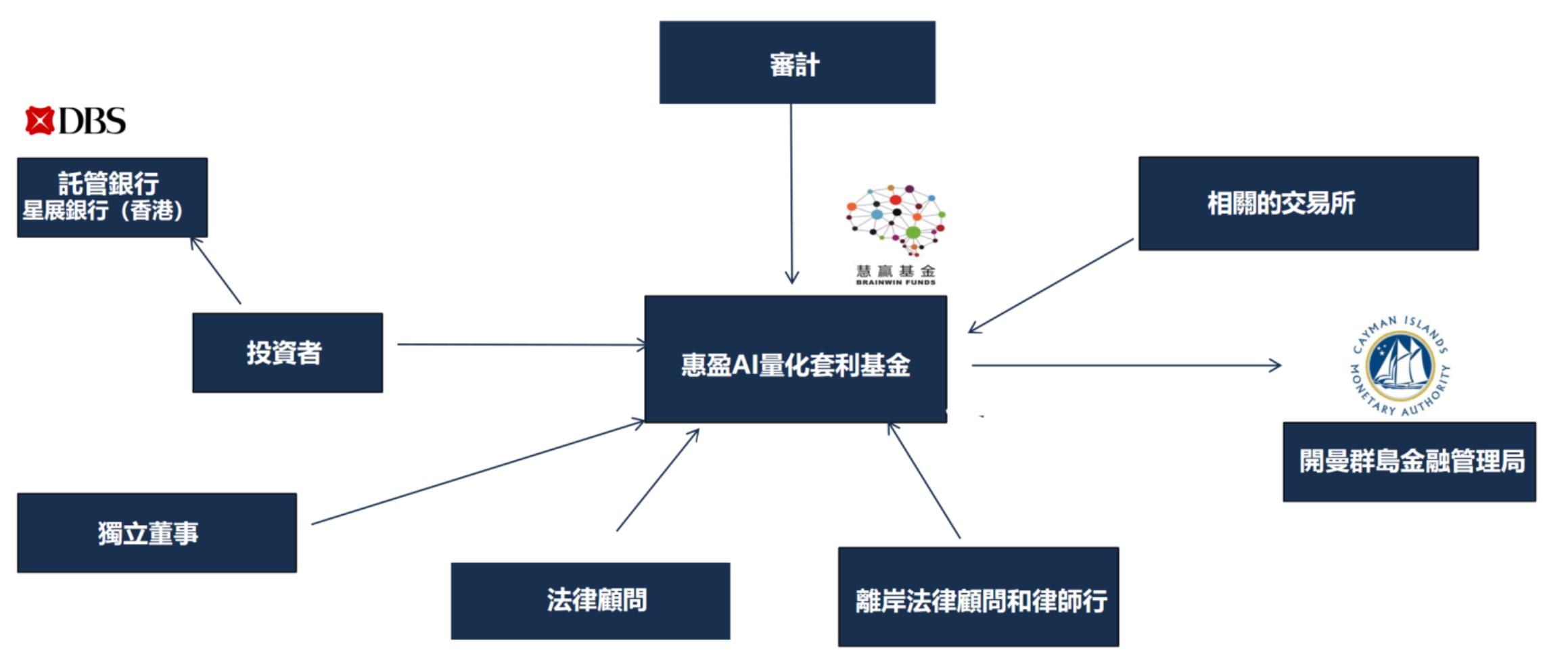

| 基金管理 | 慧贏基金管理 SPC (公司注冊號:353060) |

| 基金投資經理 | 惠盈投資管理有限公司 |

| 銀行 | DBS Bank (香港) |

| 交易貨幣 | 美元 |

| 基金規模 | 2000萬美元 (初期目標) |

| 分紅 | 每年派息8%,若達到目標回報,將按季進行派息 |

| 認購費 | 不超過認購總額的3% |

| 管理費 | A類股份:每年 2% I類股份:每年1.5% |

| 表現費 | 表現費按季度收取0%-30%; A類股份: – 回報 ≤ 8%,不收取表現費; – 回報 >8% – ≤25%,超過8%的部分,將收取20%表現費; 回報 >25%,超過8%的部分,將收取30%的表現費 I類股份: – 回報 ≤ 8%,不收取表現費; – 回報 >8%,超過8%的部分,將收取15%表現費 |

| 鎖定期 | 6個月 |

| 認購和贖回頻率 | 每月 |

| 初始認購日 | 特定類別股份在相關發售期結束時發行的初始日期 |

| 額外認購日 | 每個月的第一個營業日/或董事可能決定的其他一天或數日 |

| 贖回日 | 每月在每個日曆月的第一個營業日,第一個贖回日為購買相關參與股份後 6 個月後第一個日曆月的第一個營業日(“禁售期”) |

| 最低認購額 | A 類股為 250,000 美元, I 類股為1,000,000美元 |

我們的基金安全可靠,受到雙重保障

1) 開曼金管局對基金公司和投資經理的監管

本基金在開曼登記成立,由開曼群島金融管理局進行監管,公司注冊號為353060。

2.) 確保資金和交易安全

我們只在全球規模最大的交易所、券商和銀行進行投資和交易,以確保資金和基金運作的安全。

| 日期 | Class A 淨值 | Class I 淨值 |

| 2023 | ||

| 2022 | ||

| 2021 |