Brainwin AI Quant & Arbitrage Fund

Brainwin AI Quant & Arbitrage Fund

Market situation :

In the past three years, the financial market has become extremely volatile. Factors driving the market volatility include :

Forex(JPY/USD, EUR/USD, GBP/USD, etc.),

technology stocks (especially Chinese concept stocks, such as Alibaba, Tencent Holdings, etc.), have all fallen significantly from their highs, with a drop of up to 20%-80%.

AI quant and arbitrage investment with absolute Return

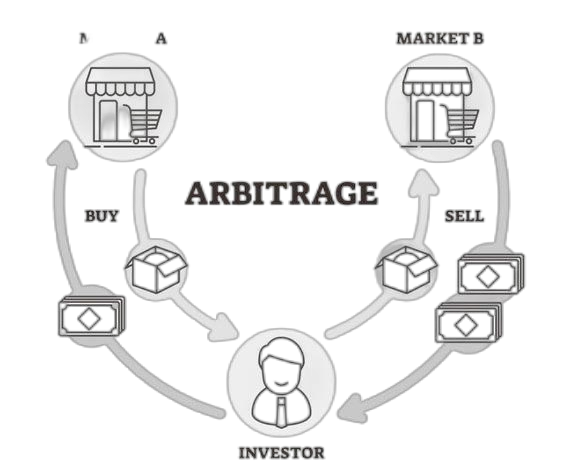

Arbitrage Strategy:The simultaneous purchase and sale of the same asset in different markets in order to profit from the differences in the asset’s listed price

No prejudgment of the market trend of each asset

Trades will only be made when arbitrage opportunities appear

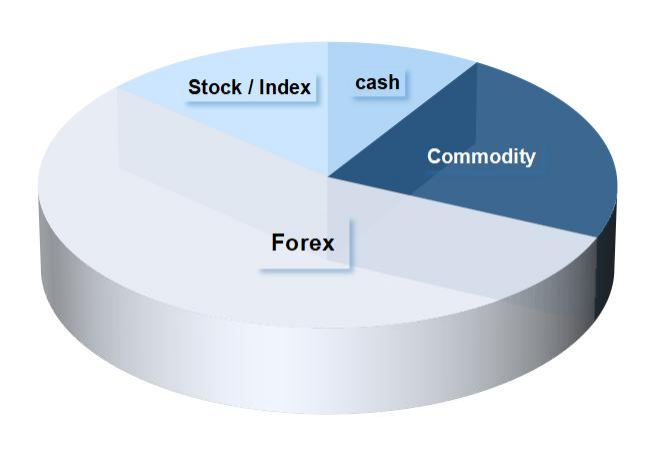

Adjust asset allocation based on the market risk and return

Control the maximum exposure of each as set class with strict risk management measures

Dynamically combine the situation in recent months, allocate the transaction to the world’s five major currencies and gold, and finally complete a portfolio with a rising and falling trend

Invest in 5-8 asset classes (including stocks, commodity and forex such as XAU, NZD, EUR, AUD, JPY, GBP etc.)

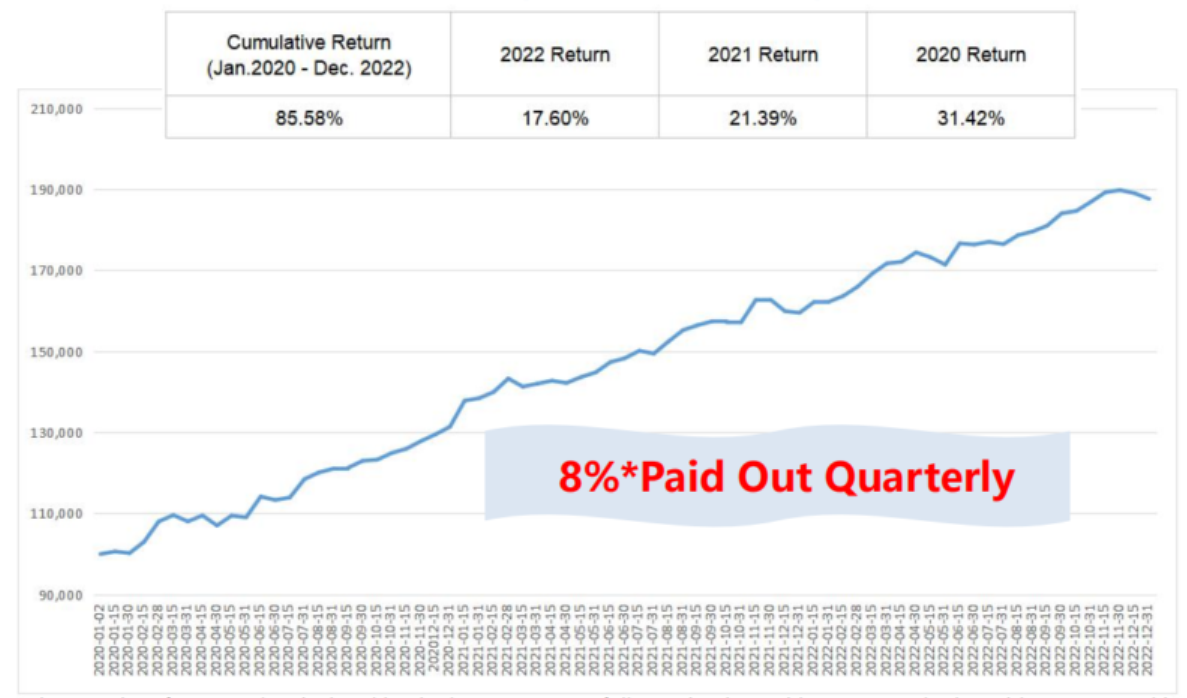

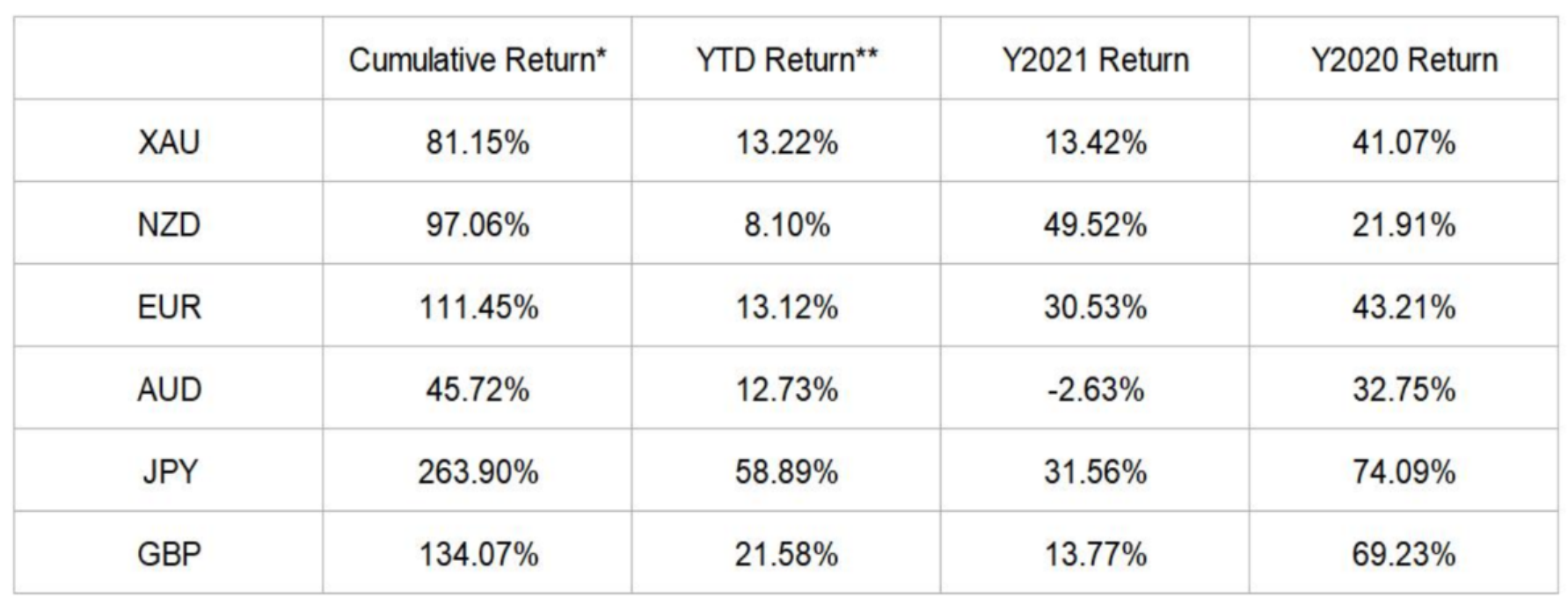

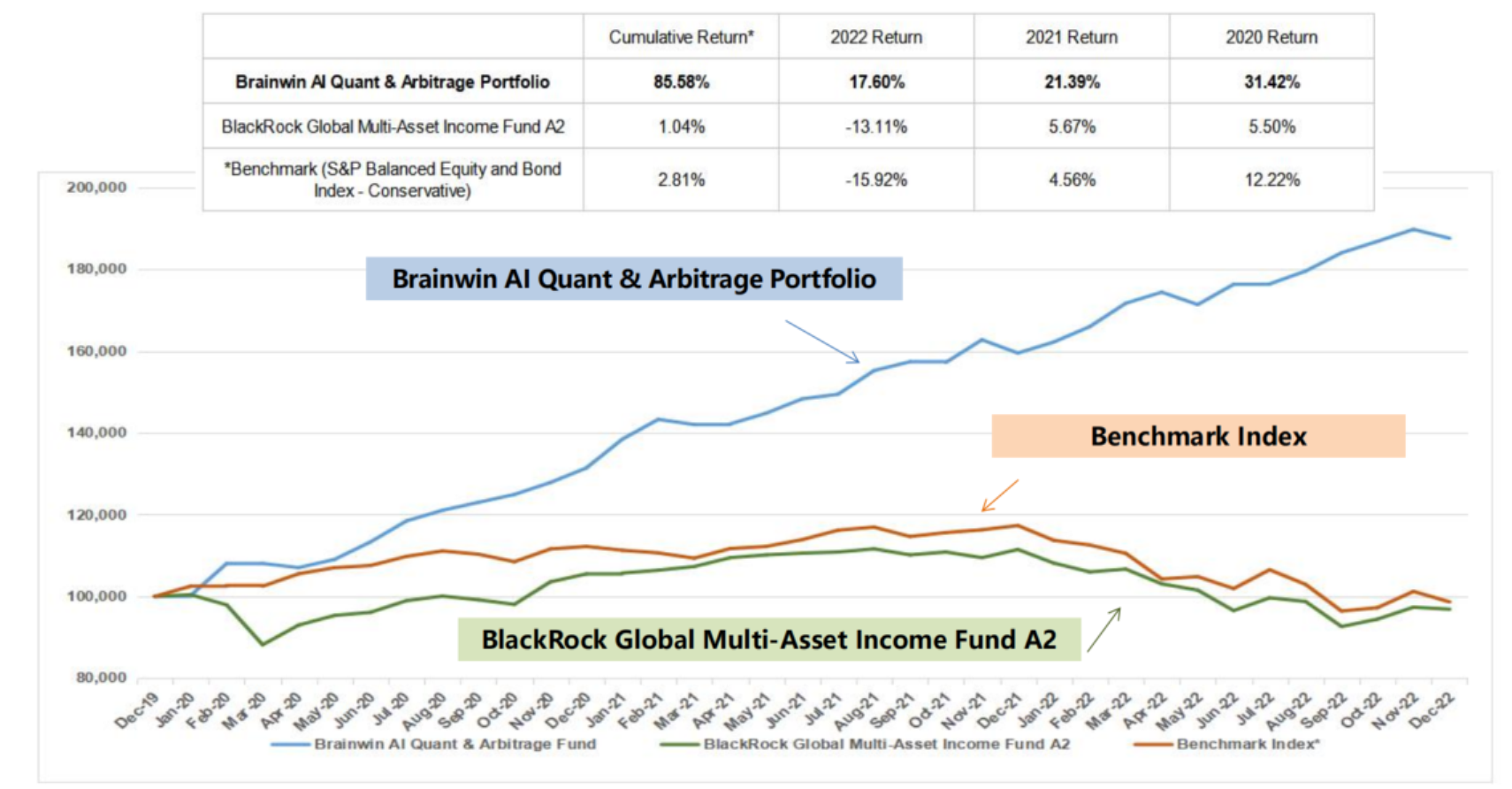

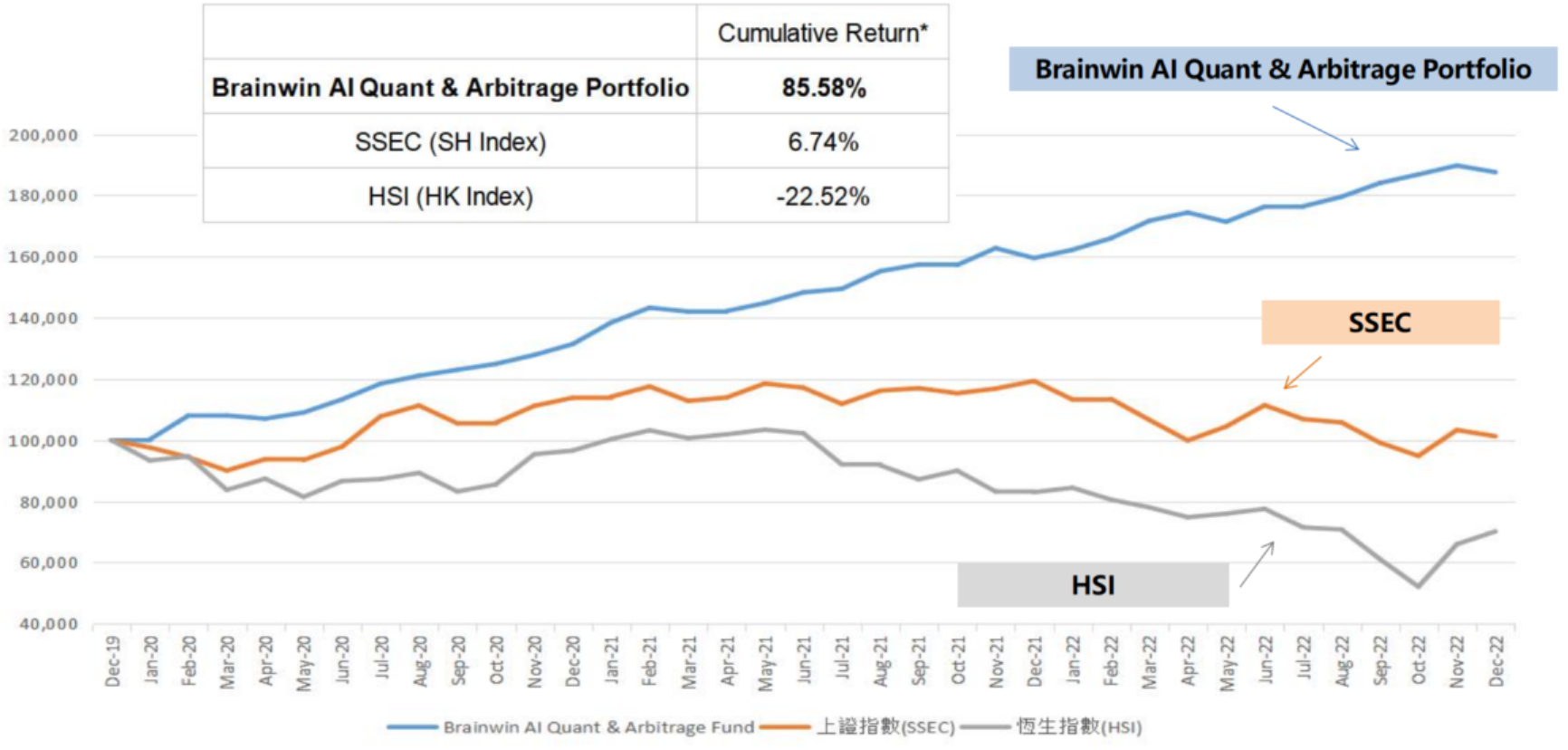

Brainwin AI Portfolio is well diversified with investment in commodities and foreign exchange. The portfolio of Gold and 5 currencies being invested in the past 3 years have achieved 85.58% (Jan 2020-Dec 2022)

**The actual performance is calculated by the investment portfolio run by the multi-asset quantitative arbitrage team with the same strategy, and the relevant content and information are true. The data is generated by different exchanges, management fees and performance fees have been subtracted, professional fees and other related fees incurred by the fund are not included, so its actual correctness cannot be guaranteed.

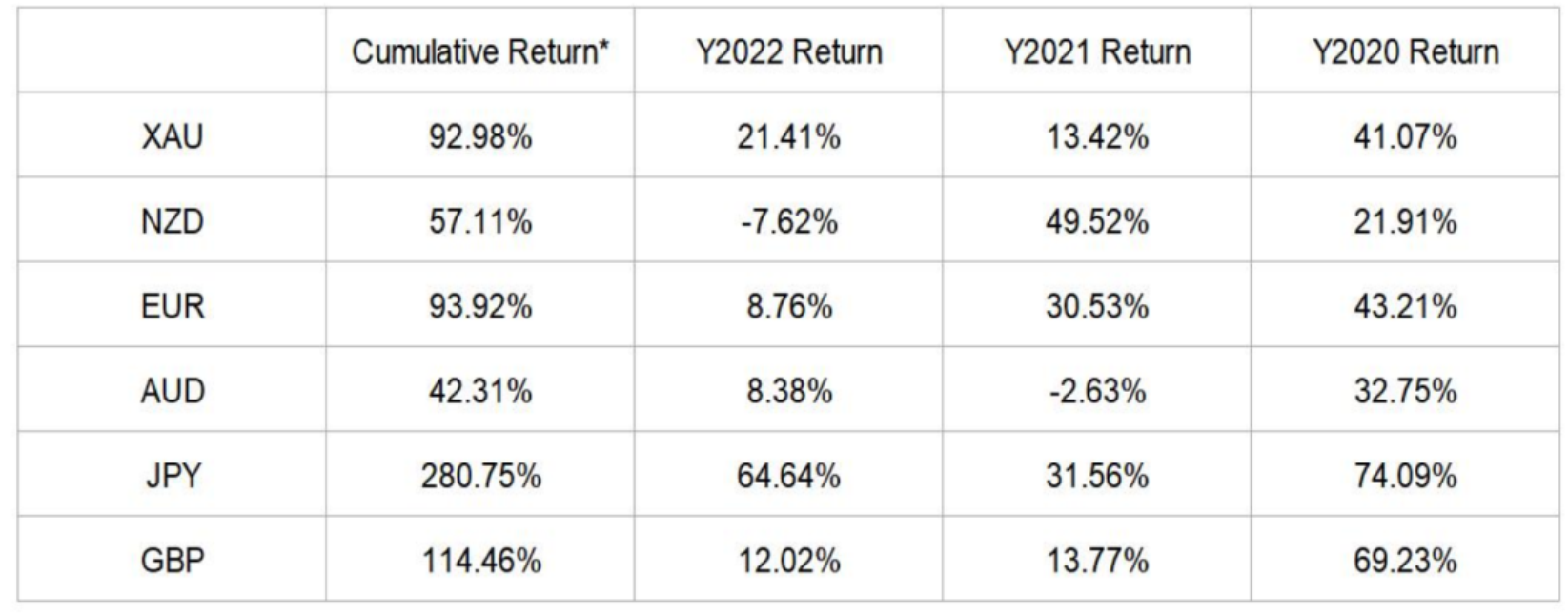

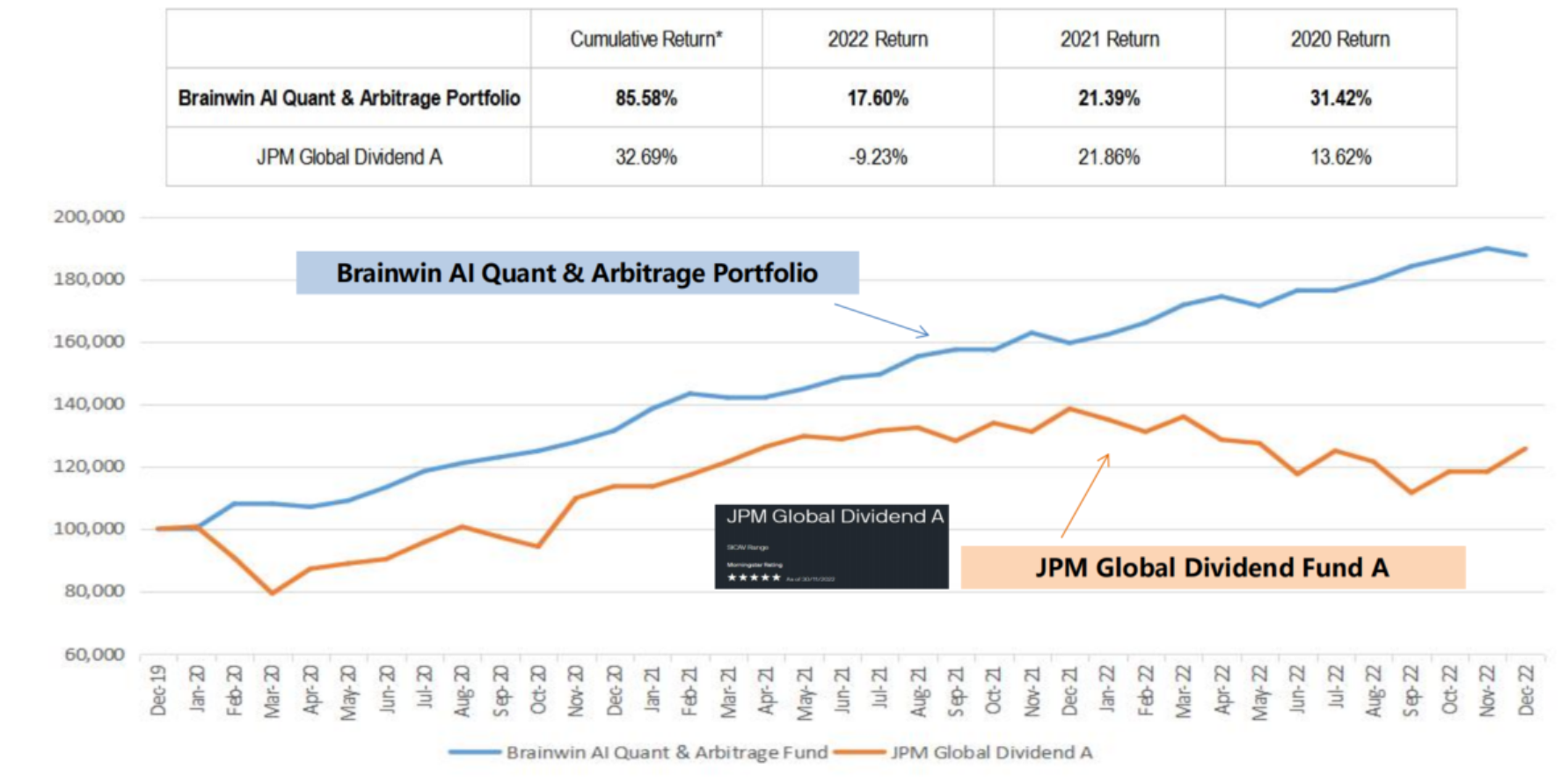

AI Portfolio “Each Asset” Performance Summary

Comparison with “Similar Category Fund”

*Jan. 2020 to Dec. 2022

Comparison with “Morningstar 5-Star Global Dividend Fund”

*Jan. 2020 to Dec. 2022

Comparison with SSEC and HSI

*Jan. 2020 to Dec. 2022

*Jan. 2020 to Dec. 2022

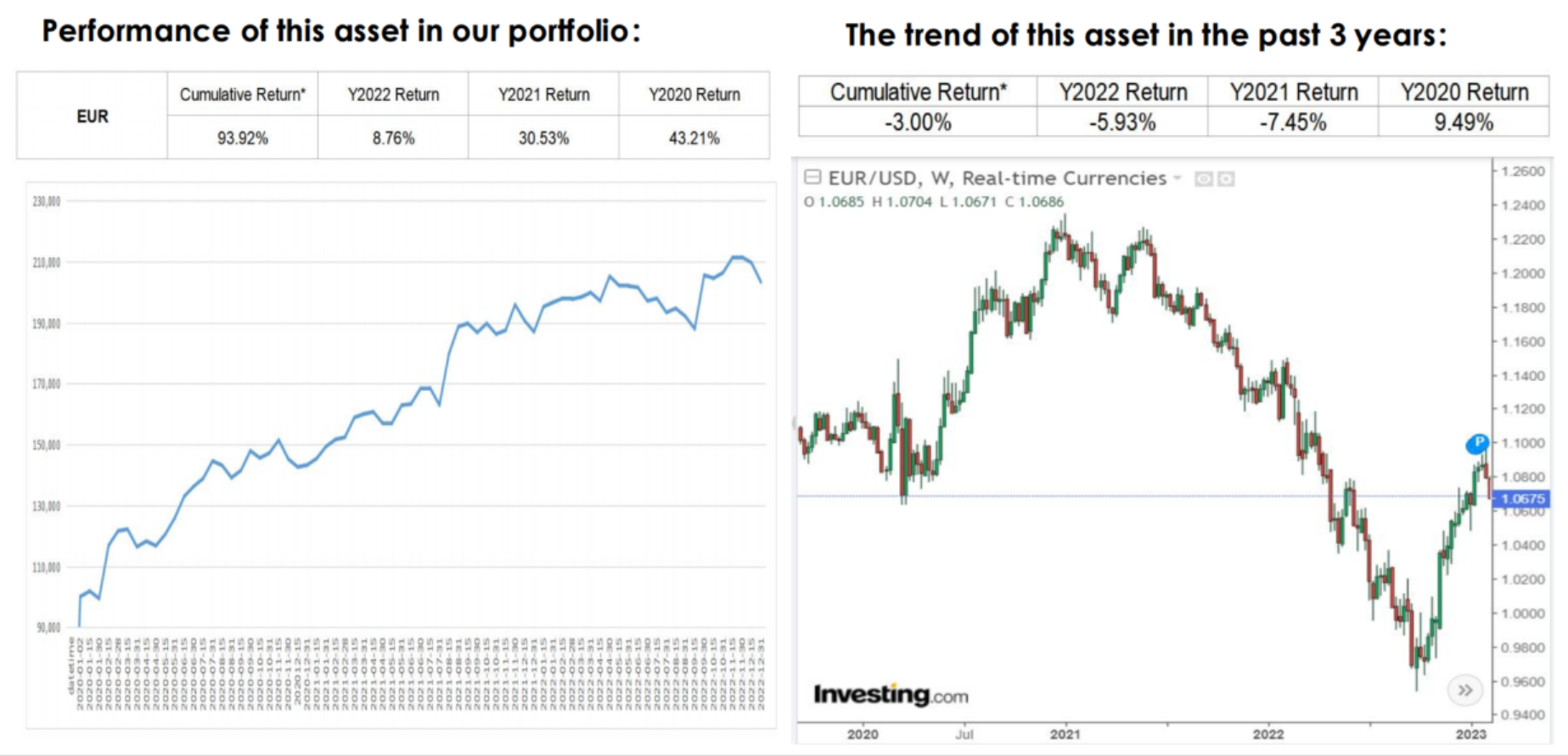

Each Asset Performance (EUR)

*Jan. 2020 to Dec. 2022

Each Asset Performance (JPY)

*Jan. 2020 to Dec. 2022

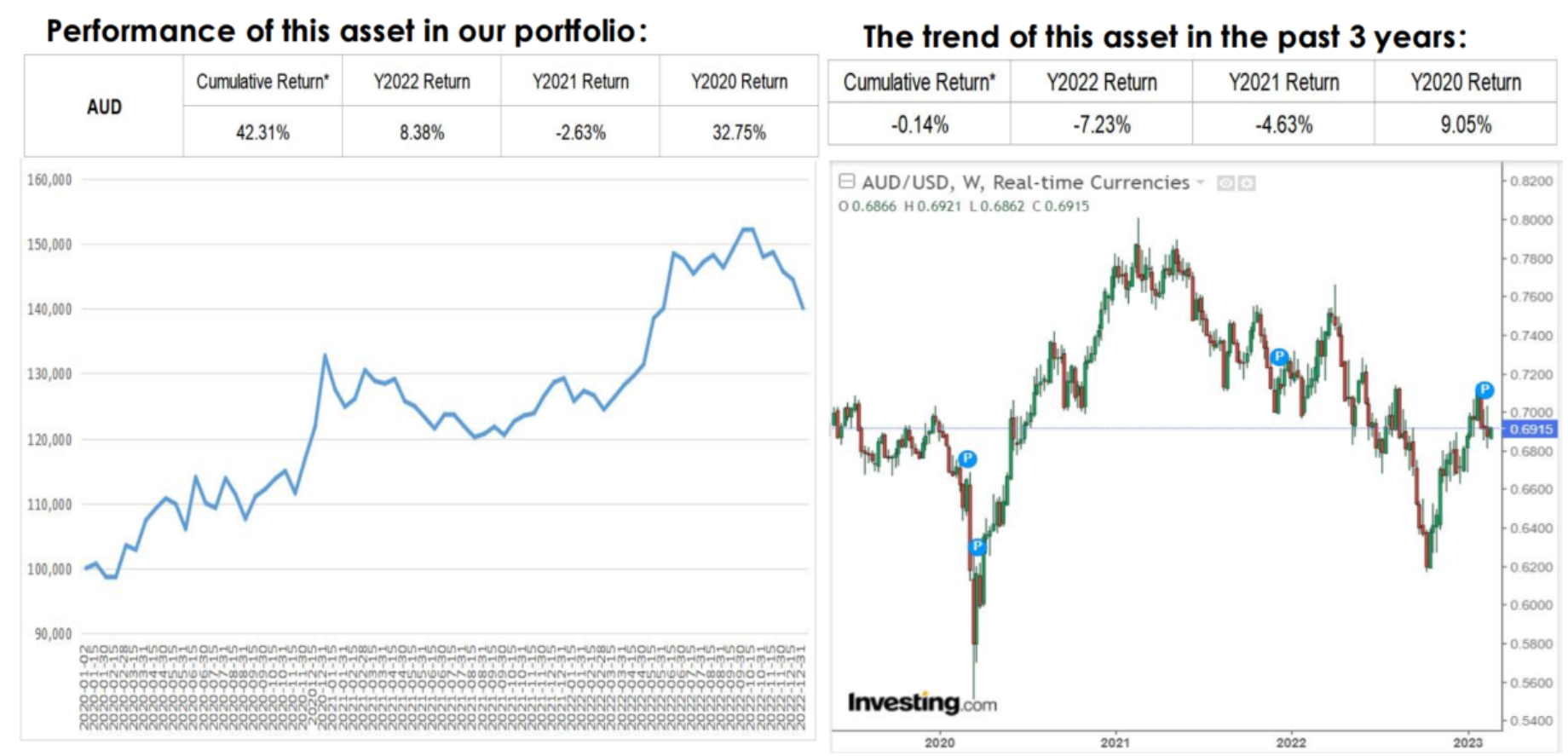

Each Asset Performance (AUD)

*Jan. 2020 to Dec. 2022

Each Asset Performance (GBP)

*Jan. 2020 to Dec. 2022

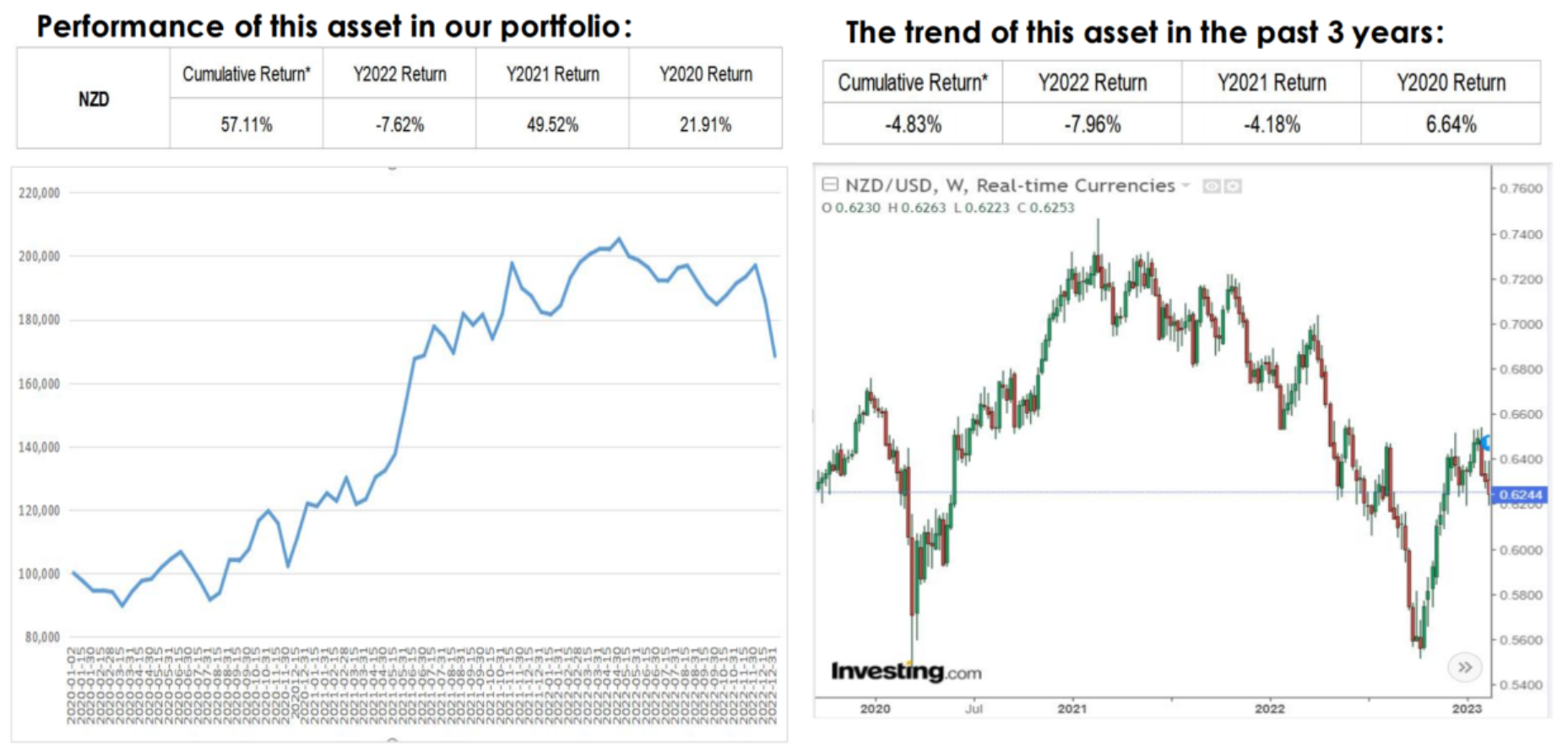

Each Asset Performance (NZD)

*Jan. 2020 to Dec. 2022

| Investment Objectives |

The Fund’s primary investment objective is to achieve low volatility and high absolute return with our diversified quantitative and arbitrage trading strategies. The fund operates through the AI trading system that automatically captures investment opportunities in stocks/index, commodities, foreign exchange, futures and derivatives on global exchanges 24 hours a day. |

| Fund Managemen | Brainwin Fund Management SPC (Company Registration No.: 353060) |

| Fund Investment Manager | Brainwin Investment Management Company Limited |

| Bank | DBS Bank (Hong Kong) |

| Trading Currency | USD |

| Fund Size | USD 20 Million (Initial size) |

| Dividend |

Dividend payout of 8% p.a., will be paid out quarterly if target return is achieved |

| Subscription Fee | Not more than 3% of subscription amount |

| Management Fee | Class A: 2% per annum Class I: 1.5% per annum |

| Performance Fee |

Performance fee will be levied 0%-30% on quarterly basis, the details as follow; |

| Lock – up Period | 6 months |

| Subscription & Redemption Frequency | Monthly |

| Initial Subscription Day |

The initial day that shares of a particular Class are issued at the close of the relevant offering period. |

| Additional Subscription Day |

On the first Business Day of each month /or such other day or days as the Directors may determine. |

| Minimum Subscription |

US$250,000 in the case of Class A Shares and US$1,000,000 in the case of Class I Shares |

| Redemption Day |

Monthly on the first Business Day of each calendar month, with the first such Redemption Day occurring on the first Business Day of the first calendar month following 6 months of the purchase of the relevant Participating Shares (the “Lock-up Period). |

| Minimum Redemption | US$100,000 in the case of Class A Shares and US$100,000 in the case of Class I Shares |

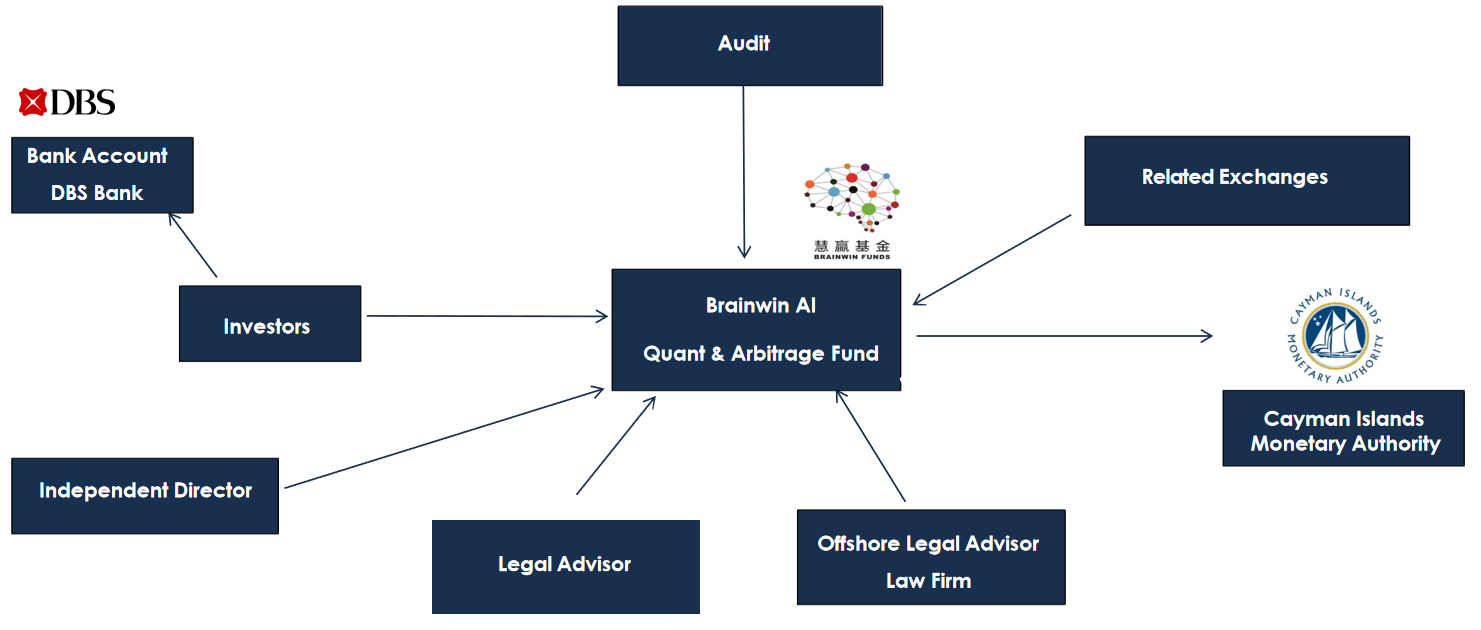

Our fund is safe and secure with double protection

1) Regulated by CIMA

The Fund is registered and established in Cayman and is Regulated by the Cayman Islands Monetary Authority.

Company Registration No.: 353060

2.) Ensure funds and tradings safety

Ensure funds and tradings safety

We only conduct multi-asset investment and trading in the world’s most scalable exchanges, brokerages and banks to ensure the safety of fund’s funding and operations

| Date | Class A net value | Class I net value |

| 2023 | ||

| 2022 | ||

| 2021 |